Fintech App Development Services

We develop mobile and web apps with a focus on fintech and cryptocurrencies. We provide full-cycle development services, from cost and time estimates to implementation and post-launch maintenance. Order the development of mobile banking and e-payment systems, blockchain apps, DeFi and Web3 apps or any fintech service.

We thoroughly analyse and work out the requirements before starting work, develop an MVP in the shortest possible time, and lay the possibility of scaling. We can work with a high load, up to 20,000 RPS and above.

We listen and hear our customers, meet deadlines, as well as offer optimal solutions for the tasks and goals set. If you are interested in the cost of creating a cryptocurrency, developing a crypto exchange or a crypto wallet, please send a request.

Financial technology (fintech) is an industry at the crossroads of finance and information technology involving financial companies that apply innovative developments. These companies use technology to improve financial performance in order to successfully compete with traditional banks and other intermediaries in the financial services market.

It’s estimated that the fintech market will be around $165 billion in 2023 and will exceed $258 billion by 2025 (in terms of volume). The industry is quickly reaching incredible heights. There are already 30,000 fintech startups around the world, and consumers are moving from traditional banking to new solutions such as mobile banking, e-wallets, and blockchain apps.

The emergence of fintech apps and services

Financial technologies have developed at different speeds. The first instance of fintech was the payment card system created by Diners Club in 1950. In this century though, a breakthrough was the contactless payment system called PayPass developed by Mastercard in 2003.

Some 20 years ago, IT departments in financial institutions were only in charge of maintaining other departments. They were responsible for ensuring that the server infrastructure containing customer data operated smoothly, was secure, and terminals provided employees with access to the said infrastructure to manage customer accounts and conduct transactions.

Interest in fintech increased significantly in the 2010s, with the ubiquity of smartphones (mainly iPhones) and 4G internet. Banks started to develop a mobile service, modernising the traditional way of providing banking services. IT began to be viewed as being much more important for them. Banks emerged that provided a set of services remotely via a mobile app while not having physical branches. They began to be called neobanks.

Aside from neobanks, startups with fintech innovations began to confidently compete with financial institutions. They also worked faster than traditional banks, weren’t afraid of experimenting with money, and offered a more convenient online service. This is how the market for financial technology apps started to grow.

The emergence of cryptocurrencies and how they have developed dynamically since 2014 has greatly influenced the world of finance. Decentralization and anonymity—the main postulates avowed by cryptocurrencies—have found support amongst many. Some have even argued that crypto projects will replace traditional banks, which, of course, is far from being the case. For a long time, however, cryptocurrencies were mainly used by geeks because there was no convenient ecosystem around. Yet, since 2017 the situation has begun to change, heading toward mass adoption.

Decentralized finance and apps are now actively developing alongside traditional finance. In many countries, the use of and mining of cryptocurrencies have been legalised, with this activity both regulated and taxed. Legislative regulation is being enhanced to prevent the use of cryptocurrencies for laundering criminal proceeds and financing terrorism. There’s less and less decentralization and anonymity in cryptocurrencies, but there’s probably no other way to integrate them with the financial system.

Fintech apps

These are web and mobile apps related to financial services. They are now widespread because the majority of financial services are delivered digitally and remotely.

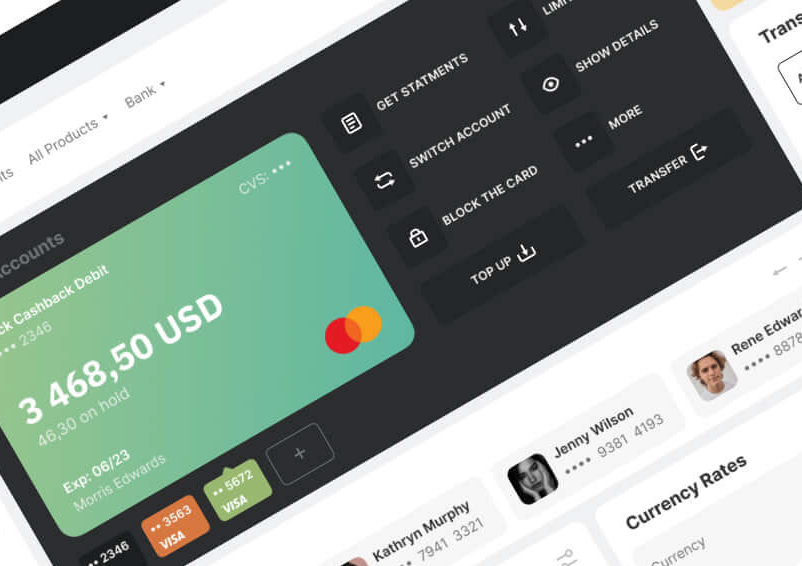

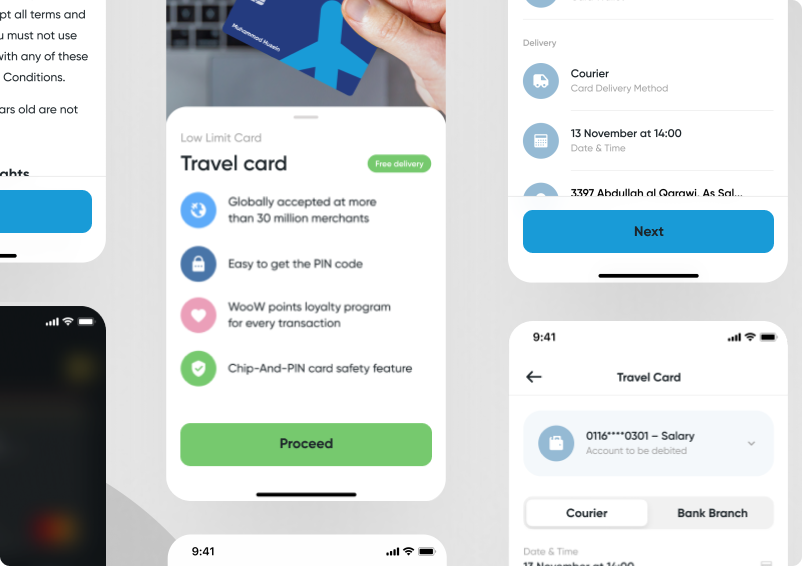

Online and mobile banking

At the heart of any bank’s operations is the Core Banking System (CBS). This is an automated banking system that processes banking transactions, updates accounts and other financial records every day. It’s also used to process deposits, credits, and loans, as well as to connect to accounting systems and reporting tools.

There aren’t many CBS developers out there. They are mainly large companies that have been in this market for decades. One such company serves dozens, perhaps even hundreds of banks. And if CBS is the core of any bank, which may be the same for various competitors, then each bank’s mobile and web app is their identity. It’s this convenience of client apps that makes up a significant portion of the competitive advantage today. Therefore, banks attach great credence to them.

The development of mobile and web apps should be part of the plans of any bank or financial company to achieve a positive customer experience. Read more on how mobile banking apps are developed.

Investments and personal finances

At the same time, many financial institutions order the development of applications that aren’t directly related to banking.

Investment apps with such features as:

- Automatic copy trading

- Monitoring and notification of changes in prices of stocks, fiat currencies, and cryptocurrencies

- Robo-adviser for investment and portfolio diversification

- Asset management with the use of artificial intelligence.

Personal finance apps with such features as:

- An analysis of financial habits along with personalized advice

- A smart digital piggy bank with support for transfers to a savings account

- Personal finance management with training on how to save

- Accounting for expenses with tips on how to save money.

Electronic payment systems

E-commerce participants are constantly on the lookout for new and convenient payment methods. Online shops and services want to accept payments through any systems and providers available. Buyers want to use an e-wallet that makes it easy to pay for goods and services, as well as to transfer e-money to other users.

A company that offers a more innovative system to the e-commerce market will receive constant revenue from commissions for payments, transfers, deposits, and withdrawals of e-money. Read more on how electronic payment systems are developed.

Polygant has vast experience in developing mobile banking and electronic payment systems. Please contact us if you need your own system or application.

Fintech app development

The success of your fintech project will depend on who and how well they develop the application for you. Basically, the entire process consists of 5 stages:

- Drawing up terms of reference (ToR).

- Agreeing upon terms.

- App development.

- In-house testing.

- Delivery to customer.

The work begins with detailed ToR because developers need to plan sprints, identify tasks, calculate the number of hours to complete them, and the total cost of work. The more detailed the ToR, the better the fintech development result will be. You can read more about the drawing up of ToR in the article ‘Our Approach.’

When in development, it is important to complete tasks on time because they are distributed across sprints. If particular tasks are delayed, then others may move on to the next sprints. Developers can’t allow this to happen, otherwise it will hold up the hand off of the entire project.

Turning to inexperienced freelancers that you will need to manage on your own or with the aid of your manager, you may encounter missed deadlines and stretch out the development for months. This will result in a waste of both time and nerves, the release of a low-quality product, or even the likelihood of the project not being completed at all.

It’s therefore better to only entrust such an important matter to a professional development team that will work efficiently and on time. Additionally, such teams already have their own team lead, with the remaining personnel having known each other for a long time and who work together seamlessly.

The Polygant team consists of professionals who have gained joint experience in developing ventures of any type of complexity. We have been in fintech for 10 years and all our clients are satisfied with the quality of financial services that we have helped to create.

Coupled with technologies modernising traditional money, new fields are developing that are worth paying attention to, such as:

Blockchain apps

These applications are based on decentralization and work on P2P networks. The following types are widespread amongst them and are mainly related to finance:

- DeFi services

- NFT auctions

- P2E games

- Decentralized exchanges

- Prediction markets.

Read more on how blockchain apps are developed. In addition, we have a separate page on decentralized finance services.

Cryptocurrency projects

Projects with their own blockchain issue a cryptocurrency called a coin, while projects using a third-party blockchain issue a token according to a particular standard. Creating a token is easier: you simply need to write a smart contract and deploy it on the network. While for a coin you need to develop an entire infrastructure consisting of:

- A protocol

- A P2P payment system

- A distributed network

- Wallets for various platforms.

Read more on how coins and tokens are issued. In addition, we have a separate page on smart contracts and their auditing.

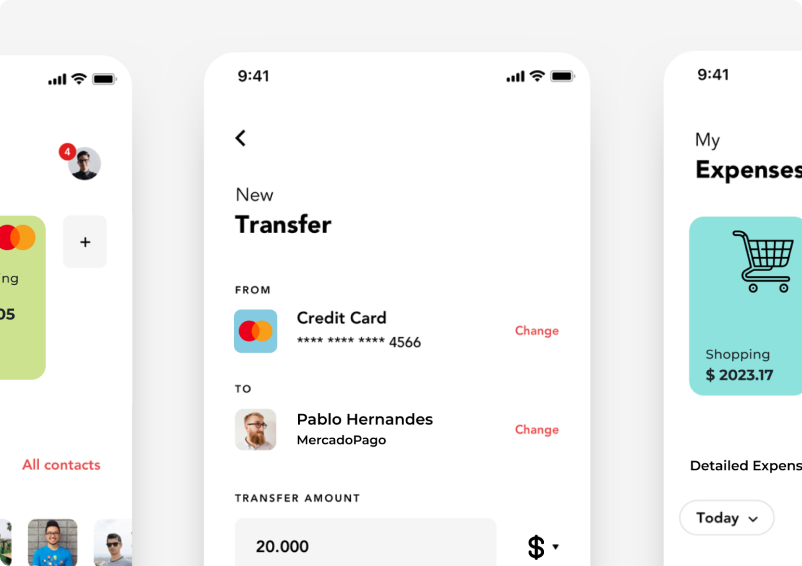

Cryptocurrency wallets

You need a crypto wallet in the form of an application, program, or online service to interact with the blockchain. Users can send and receive transactions with it, as well as check balances and the history of any addresses. The following types of wallets exist:

- Custodial and non-custodial depending on who possesses the private key and controls the cryptocurrency

- Web, mobile, and desktop depending on the platform where they work.

Read more on how crypto wallets are developed.

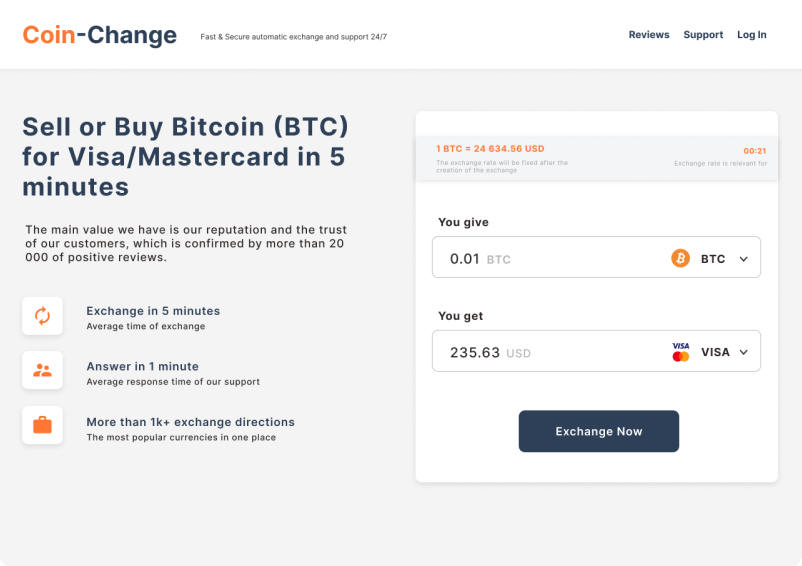

Trading platforms

While certain companies launch crypto projects with coins or tokens, others are there to help them enter the market. Cryptocurrencies find users, investors, and traders via the following fintech services:

- Crypto exchanges

- P2P platforms

- Instant exchange services.

Read more on how cryptocurrency trading platforms are developed.

Trading automation

Professional traders, investment managers, and institutional investors are keen to automate their work. With the assistance of algorithms they can react to market trends faster, without wasting time and effort on routine actions. Amongst automation tools, trading bots are more common and operate in the following modes:

- Analysis of market data and signalling of profitable moments for buying or selling

- Independent trading according to a determined strategy.

Read more on how trading bots are developed.

Fintech development services

In order to succeed or at least survive in the competitive struggle that is today’s financial sector, you need to adapt to changes, as well as to apply new financial service technologies. It’s helpful if your company has insightful managers, and customers get a positive experience via innovation.

However, if you are just planning to develop or implement a new app, then you may need professional help. We specialise in complex fintech projects, including high-load ventures.

Polygant develops innovative solutions and unique apps tailored to suit specific business needs. Write to us on Telegram or via the contact form so we can tell you more about how we can modernise your financial business.

Telegram

Telegram