We were approached by a client with the task of developing a mobile banking application for a bank that became part of the client’s group of companies. The client’s core business is a regional Latin American marketplace. Obtaining a banking licence, integrating online banking into the current business model and moving to a super-app model is a global experience of such business models.

We have received the following requests:

- Explore the market for super-app mobile applications that combine banking and marketplace use cases.

- Develop a mobile banking application that integrates the user experience of both ecosystems.

- Launch the application and develop its integration with the marketplace

- Develop a roadmap to turn the application into a super-app.

The development and launch of the application was the starting point for a global transformation of the product and business model, which pursued the following goals:

- Attracting marketplace users to a new financial product that provides profitable offers for active marketplace users.

- Transition of users from the current financial services market to the client’s banking product

- Deep integration of services for the purchase of goods and services with mobile banking

- Subscription model that gives access to the ecosystem

- Transition to the concept of “one app and one account for everything”.

Table of Contents

Market Research

We conducted a market research of super-app applications and identified their key features and benefits:

- Consolidation of many services in one application

- An open ecosystem with a simple connection to the application of third-party services – partners.

- One account for all services within the application

- Social services inside, such as instant messengers, feedback platforms that allow users to communicate with each other inside the super app

- Advanced analytics that allows you to create targeted offers for users.

Together with the client, we have identified the main advantages that will distinguish the product – a mobile banking application from other offers on the markets:

- Increased cashback and discounts when paying for goods within the marketplace.

- A subscription model that gives big discounts on the marketplace for a small fee per month when paying for goods and services through the client’s bank.

- Cross-platform analytics and the formation of personalised offers for the client.

- Opening accounts for merchants in a few clicks, favourable service conditions and low commissions.

- Integration of tax instruments. You can pay taxes and duties directly in the application.

Solution

Our team has taken the best user experience and developed an advanced interface for the mobile app.

Application Screens

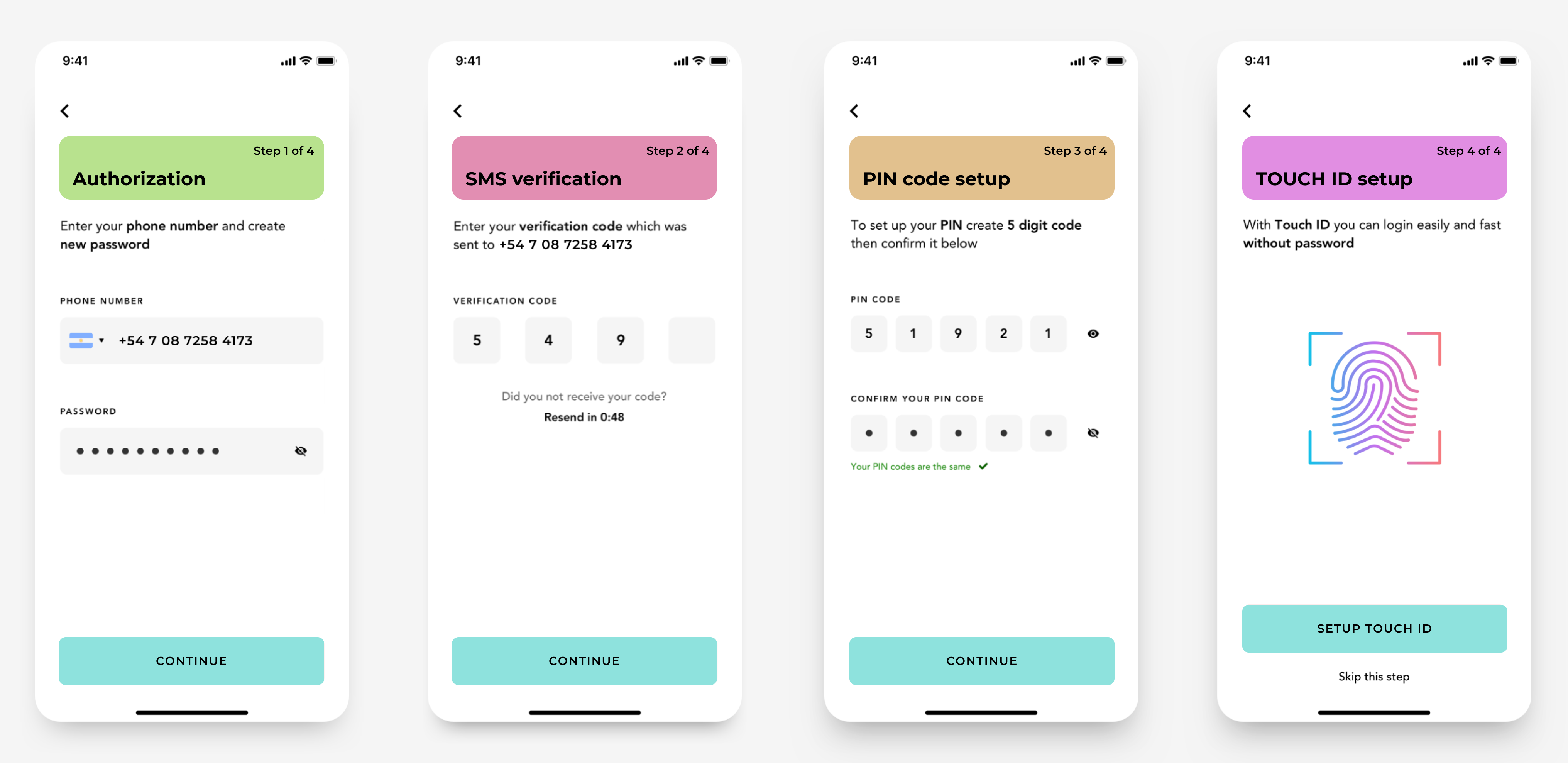

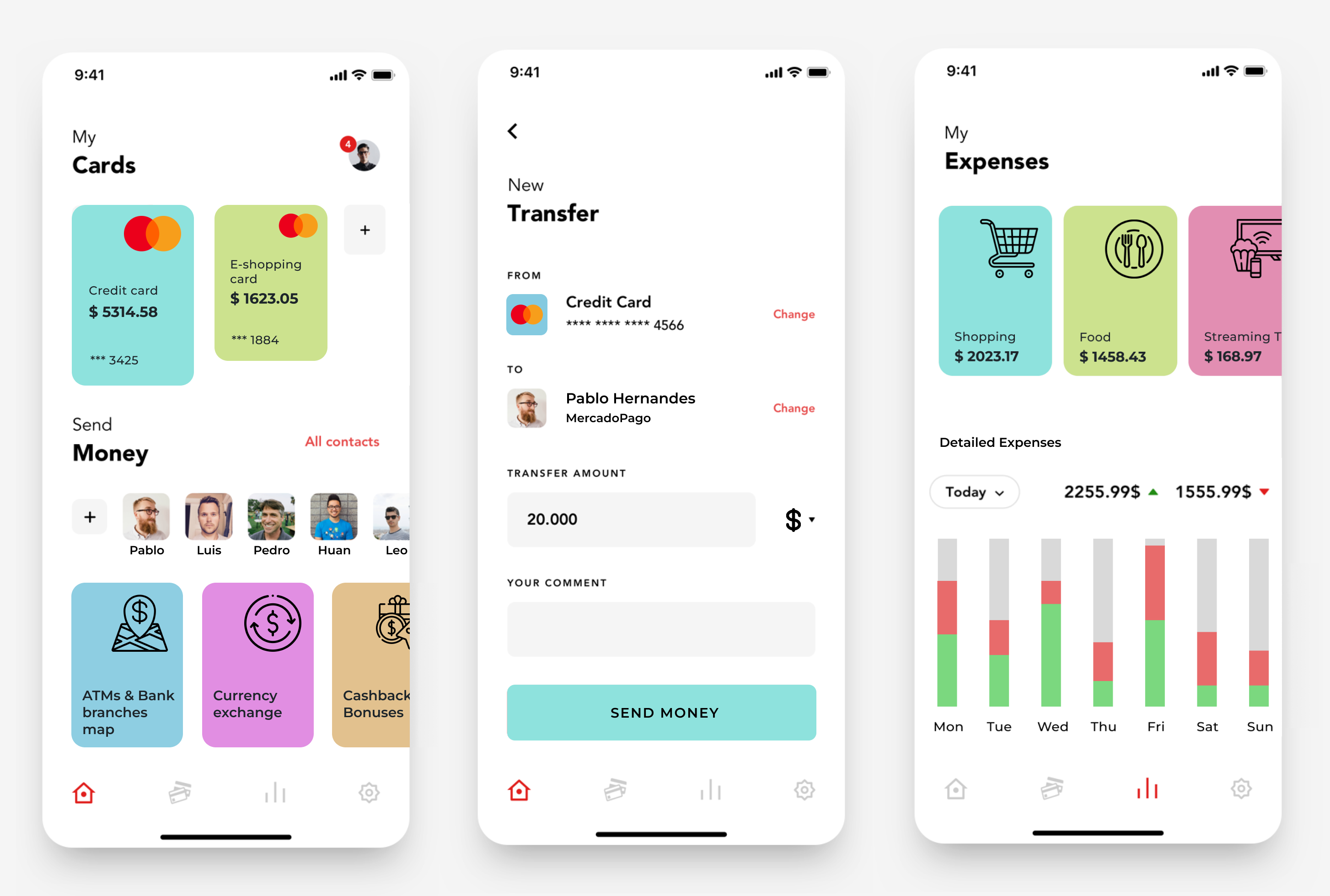

When developing UX\UI, we took into account the specifics of the Latin American market and user stories familiar to this market.

Authorization in the application

Application main screens

Technologies

For OLA Bank, we have developed native applications using Swift for iOS and Kotlin for Android. To connect the mobile application with the banking infrastructure, we used the Open Banking API. GraphQL, gRPC and Socket.io technologies were used for stable and fast data exchange between the application and the server side.

Project timeline

The app development took 10 months. Within the specified time frame, we have done:

- Conducted market research

- Developed a concept

- Developed UX\UI

- Implemented the OLA Bank mobile application

- Launched the application on IOS and Android and put it in the stores

Telegram

Telegram