Smart contracts allow for performing indisputable and transparent transactions concerning money, property, stock, and other assets. Smart contracts can be compared with vending machines that provide snacks and beverages. Traditionally, you would have to visit a lawyer or notary with this issue, and then wait for them to issue a document. Besides, do not forget about fees. Smart contracts let you ‘insert a crypto coin’ into the machine, i.e. distributed ledger, and get your certificate or another document. Also, smart contracts not only lay down the rules and give penalties, but also force to follow rules without question.

Table of Contents

Practical application of smart contracts

Smart contracts can be used in various fields of activity. In business operations, for example, they augment profits. The key areas where one can benefit from using smart contracts are as follows:

- Trading

- Real estate

- Taxes

- Insurance

- Gambling

- Inheritance

- Election.

We will describe some practical cases below so you could understand how blockchain-based smart contracts work.

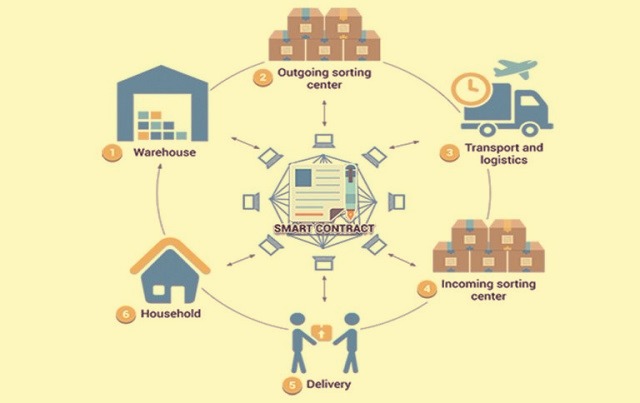

Goods delivery

Today, it’s common for lots of users to make orders in online stores. Most frequently, these orders are paid on delivery, which implies additional expenses for a customer. Smart contracts can release from this burden. Before shipping, the amount is charged from the customer account and put into a blockchain. Upon receiving goods by the customer, the amount is transferred to the seller account. One can set additional optional conditions in a smart contract, namely:

- Delivery time for the parcel. For example, if delivery is significantly delayed, the money will be returned to the buyer.

- Storage time for the parcel. For example, if the buyer doesn’t pick up the parcel in a timely manner, a penalty will be charged and the remaining money will be returned, while the parcel will be returned to the seller.

Leasehold

Smart contracts provide for entering into reliable real-estate deals. Let us learn how a smart contract works in leasehold. The lessee concludes a fixed-term agreement with the landlord. The deposit and first-month rental payment are put into a blockchain. After that, the lessee gets the keys. For proper smart contract operation, the lock of the leased property must be connected to the Internet. Should the lessee fail to pay the rent by the second month, the lock gets blocked. Upon the expiry of the lease term, the deposit is refunded to the lessee. It also can be transferred to the landlord account in case of infringement of lease conditions or property damage.

Sports betting

Imagine you and your friend plan to bet on the same match but opposite teams. Bets are charged from your accounts and put into a blockchain. When the match ends, the smart contract will check the result and transfer the amount to the winner. Most sports games have such a thing as a draw — in this case, bets are returned all gamblers. Smart contracts are more valuable than bookmakers due to absolute transparency and no fees.

Division of inheritance

Smart contracts can operate even after the death of one of the concerned parties. In the past, these processes required involving lawyers and counsellors, but they were not always fair and could even snatch control of the property. This problem can be easily solved with the use of smart contracts. For example, someone owns grave money on his accounts and wants to bequeath his wealth to a relative. A smart contract checks the register of deceased persons; if the party’s death is confirmed, then their funds are transferred to the specified successor.

In fact, there are way more areas and examples of application, so it is no surprise that such giants as Amazon, Google, IBM, Microsoft, and others are interested in smart contract development. Even leading countries are concerned with designing smart contract structures to start using them for the good of their residents.