Businesspeople from various industries have come to realise the benefits that blockchain technology provides if implemented in a company. It already benefits many areas of business, for example: trade, rental real estate, educational and entertainment services. However, blockchain has affected the financial services field most of all, as one would expect from financial technology.

Table of Contents

Who needs blockchain

If we put aside crypto projects, then blockchain has already begun to be actively introduced into all kinds of financial institutions:

- Commercial and investment banks

- Non-banking financial and credit companies

- Investment firms and funds

- Exchanges of any markets.

This trend can be explained by the fact that since 10 January, the European Union has been implementing AMLD5 (the Fifth Anti-Money Laundering Directive), stipulating regulators require and verify detailed information about transactions and their participants. Since 21 June 2019, updated recommendations by FATF (the Financial Action Task Force on Money Laundering) along the same lines have been in force outside the EU. They have become the norms and even unspoken requirements established for the financial sector. The main goal of the new rules is to accustom companies, with the help of supervisory authorities, to put customers through KYC and AML procedures in order to maintain the transparency in all financial markets.

What KYC is

Know Your Customer (KYC) is a practice and set of rules that companies providing financial services to individuals adhere to. They require documents identifying customers in order to provide reliable information about an individual should financial and law enforcement agencies request them for a particular case.

In the 2000s, KYC began to be used as a form of identification for private customers when they conduct financial transactions. The operators of financial institutions didn’t have any difficulty with this task at their offices, simply checking the ID or passport presented with a customer’s face. But through the Internet, it was difficult to establish the authenticity of documents and their identity with the bearer. Shady figures often slipped other people’s scanned documents into electronic payment systems or even drawn up ones with fictitious data. Identification at that time meant only eliminating anonymity by collecting personal data.

In the 2010s, everyone began to have laptops, tablets, or smartphones with powerful cameras and broadband Internet in them. Then, KYC, in addition to identification, began to include verification, that is, matching documents with the bearer and simple authentication. Operators of online banks and payment systems began to ask customers to take pictures with the necessary document in their hands, and to photograph them from different angles. If this was not enough, then they could make a video call. This minimised the likelihood that someone could illegally get someone else’s selfie with a document in their hands.

How blockchain is useful for banks

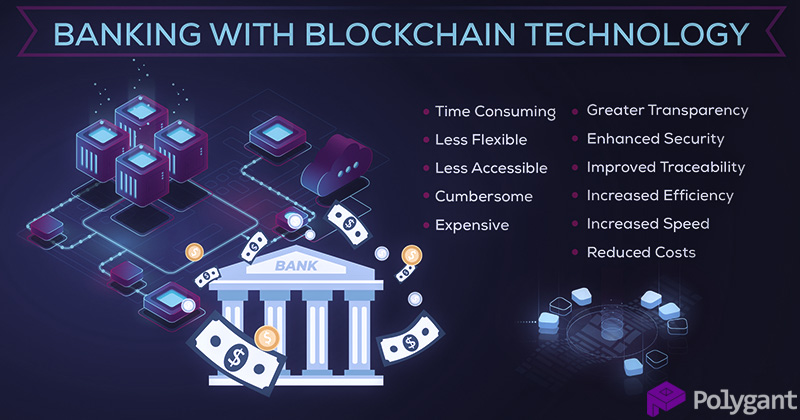

As blockchain technology advances, people are seeing transformations in the financial services field. The technology, originally intended for cryptocurrency payment systems, is now being used by financial companies working with fiat money.

Banks are introducing blockchain in order to optimise the collection of personal data and transfer it to a distributed network, where all customer information will be securely kept. Identification and verification management is the primary task that arises before processing transactions. In such important processes, there are bottlenecks that periodically create problems: the risk of errors when entering data, the likelihood of duplication, and the very process of going through KYC is tiring for customers. All this can lead to the appearance of a negative experience.

Blockchain improves KYC

To understand why banks, while disapproving of cryptocurrencies, welcome blockchain, you need to consider this technology’s advantages. Here are the key features that help banks improve KYC:

- Decentralization helps to store databases in a distributed way on different servers. Moreover, each server in a particular branch stores only the data collected in its office. All branches exchange information directly with each other, which means that they do not need a central server from the main office.

- Cryptography helps encrypt personal data using reliable algorithms. Only authorised employees have access to the databases using their keys. Customers no longer have to worry about the confidentiality of data transmitted to the bank during the identification process.

These are not the technology’s only advantages, but only those that are used to store and access data received via KYC.

Blockchain improves service

Banks and their customers are confident that the emergence of blockchain has transformed financial services and changed the interaction of companies with people for the better. If the technology is used by many and not just large companies, this will help standardise a new approach to customer service. With just a slight correction, we’ll soon see what was predicted in the Harvard Business Review:

Blockchain will do to the financial system what the Internet did to the media.