Neobanks appeared in the banking system 10 years ago. They were oriented more towards mobile devices and aimed to only establish digital relationships with clients who were good with technology. Their number grew every year, since they attracted people with the opportunity to do mobile banking conveniently and almost entirely free.

However, a recent research by Simon-Kucher & Partners, strategy and marketing consultants, has shown that only 5% of neobanks operate without a loss. The others can’t cover their expenses, which is most assuredly connected with the current interest rates. This means that it’s difficult for them to compensate for not having a model based on income from commissions.

Table of Contents

Stats from Neobanking Radar

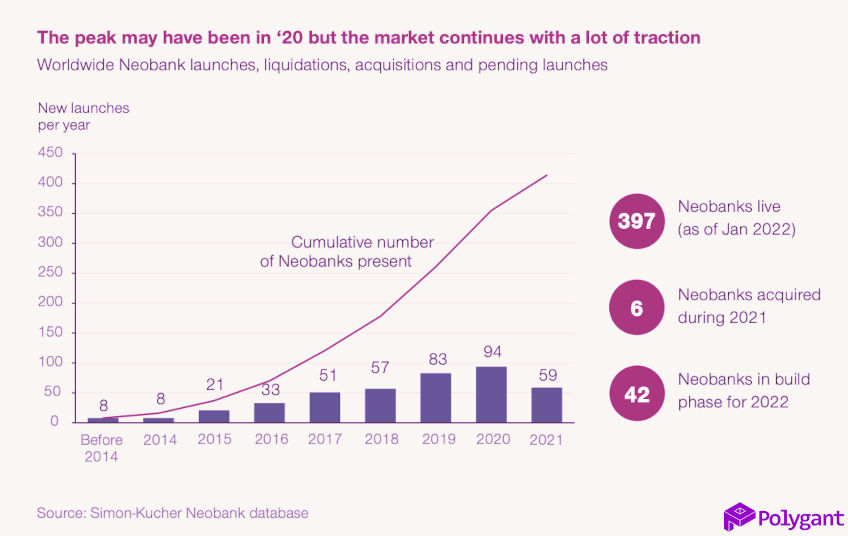

Simon-Kucher & Partners have assembled a global database called the Neobanking Radar, in order to monitor and rank neobanks based on their growth potential. By their accounts, there are 397 neobanks in the world, and together they serve over 1 billion customer accounts.

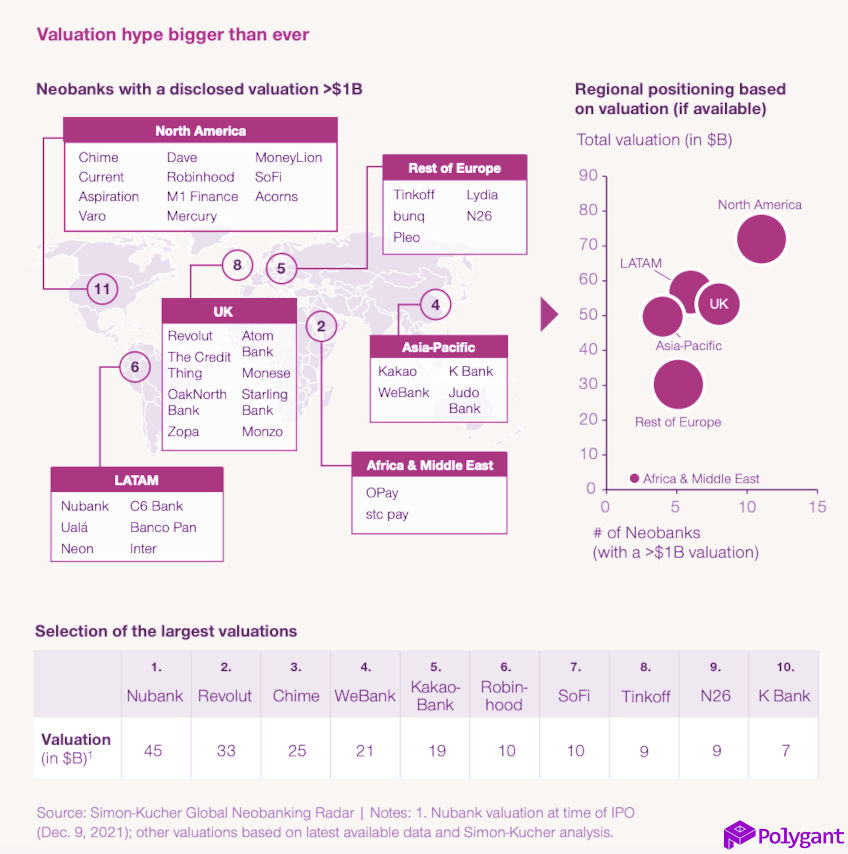

In the USA, there are 85 neobanks, who serve over 100 million retail customer accounts. Of them, only a very small proportion doesn’t operate at a loss. Some of them are in such a bad position that they are losing $140 per client every year.

In Germany, there are 26 neobanks, who serve over 7 million retail customer accounts. According to the rankings, they are in a better position compared to other countries, being in 8th place out of 60. This is most likely due to the fact that local banks entered the market quite early.

Globally, the situation looks quite alarming. An analysis of the world’s 25 largest neobanks has shown that only 2 of them have become profitable, and the vast majority of the remaining have an income of less than $30 per year from every client.

Finally, according to Simon-Kucher & Partners, these events will change the structure of digital banking in the near future:

- The number of neobanks being launched is lower than the peak in 2020, when 94 new neobanks came onto the market. In 2021, only 59 opened, and during 2022, another 42 will have opened.

- Every third neobank launched is an ‘innovation speedboat,’ or a subsidiary bank of a large financial group or traditional bank that only works with digital technologies.

Five mistakes that stop neobanks making a profit

Simon-Kucher & Partners have carried out an analysis of neobanks and identified mistakes that prevent them from reaching at least the break-even point:

- Not focusing on specific markets — either on domestic markets, or on markets that look promising since neobanking hasn’t yet been developed there. Many banks build new markets too quickly, despite the risk that they may not be successful due to the fact that the rules there are different from what they are used to.

- Failing to innovate further once a minimum viable product has been created. As soon as a product has been developed, neobankers often spend too much time savouring their successful launch, instead of looking for the next trends and developing their banking product further.

- Concentrating on increasing the number of clients rather than on making profits. This is related to the desire of banks to become popular faster and attract more venture capital investment. Banks should consider that venture capitalists expect a return on their investment.

- Not having a sustainable income model. Having a free entry-level plan will attract more clients, but won’t provide income. Therefore, banks should sell more paid services.

- Underestimating the complexities of banking and the rules associated with it. This is particularly noticeable on the markets of developing countries outside the EU.

The future of neobanks

Despite the fall in the number of new neobanks in the past few years, more of them will appear in the future. This will be facilitated by the growing demand for digital banking services by younger consumers, as well as increasing trust for neobanks from consumers of all ages.

Today, the US leads in the number of neobank account holders — 40 million people. By 2026, there will be 50 million holders of bank accounts that are handled digitally. The US will maintain this growth thanks to its large population and the fact that it has one of the oldest banks in the world to operate exclusively with digital technologies.