Table of Contents

Introduction

We were contacted by a client who issued the FITTY COIN cryptocurrency in the form of an ERC-20 token on the Ethereum blockchain. After listing the coin on centralized exchanges, the client found that the coin’s chart looks broken and trades are rare. When users buy or sell a coin, the price is very different, with large purchase volumes, the price rises a lot, and then when selling, it also drops a lot. The client wanted the coin rate to remain in a stable price range, and when selling or buying, the price did not go beyond it.

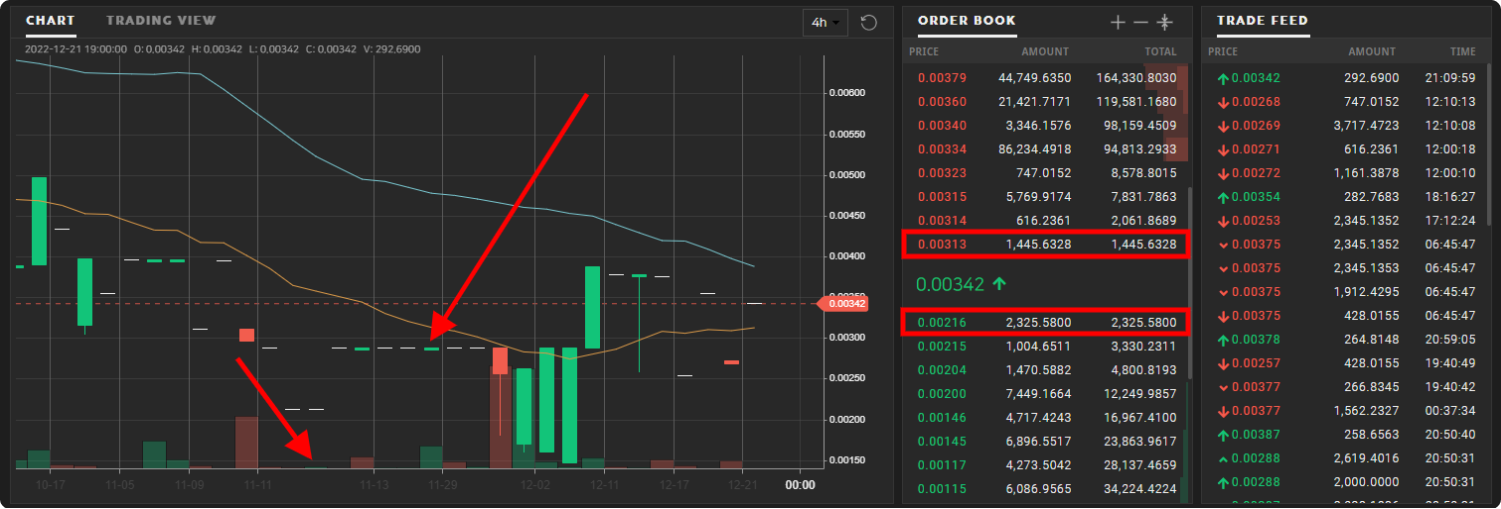

In the screenshot above, you can see a broken chart and a spread of about 20% for a FITTY COIN without market making.

Our team analyzed the current state of trading of the client’s token, the client’s needs, and identified the main factors, the improvement of which will solve the client’s problem. The client chose our market making service, with which he was able to achieve his goals.

We changed the brand name and blurred out any references in the screenshots so as not to violate the NDA for our client.

Peculiarities

The tasks of market making in this case are:

- Maintaining liquidity in the pair. The user can buy or sell the required amount of coins at the market price without significant exchange rate fluctuations.

- Filling the order book and maintaining a low spread. The market maker places orders for buying and selling in the order book on the exchange as a direct bidder.

- Orders are arranged so that the spread – the difference in price between buying and selling is minimal and corresponds to the market average.

- The volume and number of applications in the order book are negotiated with the client, based on the funds pledged for market making.

- Maintaining a stable exchange rate. When users execute orders (orders) placed by the market maker, the market maker promptly places new orders so that the rate does not fall or grow more than agreed with the client. If the user simultaneously executed a large volume order and the price went beyond the specified range, the market maker returns the rate to the established limits and restores the order book.

- Visual representation of trading in the form of a chart on the stock exchange. The market maker trades the coin so that the coin chart does not look torn and there are no gaps (a large gap between auctions) at the main time intervals.

- Maintaining the correspondence of the rate between different pairs and exchanges. The coin is traded in pairs with a stablecoin and bitcoin on one exchange and in a pair with a stablecoin on another exchange. It is necessary to support coin trading in different pairs and on different exchanges so that there is no significant difference between coin rates and there is no opportunity for market speculators to arbitrage a coin when a speculator can buy a coin in one of the pairs on the exchange and immediately sell it to another pair, earning on it at the expense of users or a market maker.

Implementation

To launch FITTY COIN market making on the centralized exchange, we registered an account and received the status of “market maker” on the target exchange. This is necessary to receive the minimum commission for trading.

Next, we integrated the API (automatic programming interface) of the exchange to work with the market maker bot. Most market making operations are carried out by a special program (bot) according to a given algorithm. The advantage of automated market making is that it can work around the clock and follows the strategy more closely than a human can.

After integrating the exchange API, the work of the bot was tested: receiving data on the coin and trading, placing orders, tracking and managing them. For each of the exchanges, due to their technical features, the bot is adjusted for faster and more accurate work.

We have provided an alert system that is integrated into the market maker bot, which monitors the market situation in a trading pair and reports on emerging emergency situations and imbalances. When receiving a message from the bot about a certain event, a person can manually make adjustments to the trades directly through the exchange interface or change the bot algorithm.

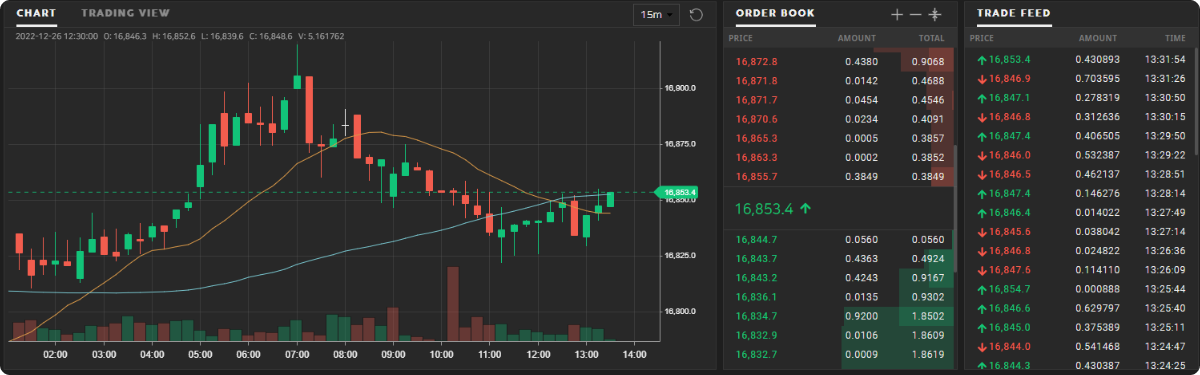

After full integration and technical testing, the work of market making was demonstrated to the client. The client, using a good example, saw how market making works and how it solves the tasks: it provides liquidity, maintains a stable exchange rate and liquidity of the coin in trading pairs on the exchange.

At the last stage, we launched market making in working mode.

Then we carried out work on market making in support mode, provided reports on the work to the client, adjusted the market making strategy to maintain a stable FITTY COIN rate depending on changing market conditions and tasks.

Telegram

Telegram