Table of Contents

Introduction

One of the clients who contacted us for the development of the DEF COIN cryptocurrency on their own blockchain also needed a market-making service. The client planned to launch cryptocurrency trading on several exchanges, systematically increase the popularity of the cryptocurrency, and, accordingly, counted on a change in the rate of the coin.

Our team coordinated the client’s expectations with how the coin is being distributed on the market, how the demand for the coin is increasing, and how best to implement market making in the client’s case in order to fulfill the client’s expectations regarding the coin rate through a trading strategy and regulation of the coin supply on the exchange.

We changed the brand name and blurred out any references in the screenshots so as not to violate the NDA for our client.

Peculiarities

The tasks of market making in this case are:

- Maintaining liquidity in the pair. The user can buy or sell the required amount of coins at the market price without significant exchange rate fluctuations.

- Filling the order book and maintaining a low spread. The market maker places orders for buying and selling in the order book on the exchange as a direct bidder. Orders are arranged so that the spread – the difference in price between buying and selling is minimal and corresponds to the market average. The volume and number of orders in the order book are negotiated with the client, based on the approved trading strategy.

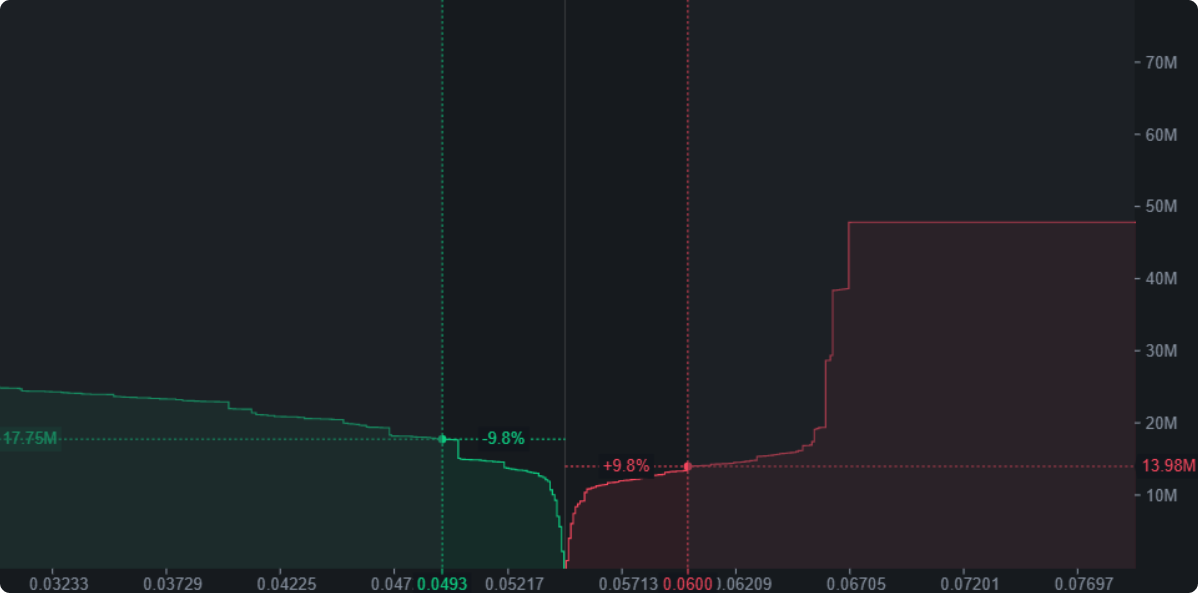

- Implementation of a trading strategy through the management of the coin supply on the exchange. As the popularity of the coin increases, so will the demand for it. Each user will want to buy it without overpaying. In order to satisfy both the user and the client, the market making trading strategy changes the supply of the coin in the order book so that the change in the rate takes place in stages and without sharp jumps. With a smooth iterative change in the price of the coin, in which periods of growth are combined with periods of correction, a more mature and stable market is formed.

- Visual representation of trading in the form of a chart on the stock exchange. The market maker trades the coin so that the coin chart does not look torn and there are no gaps (a large gap between auctions) at the main time intervals.

- Maintaining the correspondence of the rate between different pairs and exchanges. A coin can be traded in pairs with a stablecoin and bitcoin on one exchange and in a pair with a stablecoin on another exchange. It is necessary to support trading of the coin in different pairs and on different exchanges so that there is no significant difference between the rates of the coin and there is no opportunity for market speculators to arbitrage the coin.

Implementation

With the client, a detailed trading strategy plan for coin market making was developed after the launch of trading on the exchange. To do this, agree:

- coin listing price,

- goals for changing the exchange rate of the coin,

- time periods for rate change stages,

- the volume of distribution (sales) of the coin in the given time periods,

- the amount of accumulation (purchase) of the coin in the given time periods.

Next, we carried out the necessary technical work to integrate automatic market making and the target exchange:

- We registered an account on the target exchange and received a special status of “market maker”, which gives minimal commissions for trading operations.

- We integrated the API of the exchange and the market maker of the bot. Most market making operations are carried out by a special program (bot) according to a given algorithm. The advantage of automated market making is that it can work around the clock and follows the strategy more closely than a human can.

- We tested the interaction between the market maker bot and the exchange and made the necessary improvements. At this stage, we are debugging the receipt of data on the coin and trading, placing orders (orders), tracking and managing orders.

- We tested the program logic of the trading strategy in various market situations.

- We set up a system of notifications – “alerts”, which the bot program automatically sends in certain market situations that require human intervention. For example, a client representative and a technical employee receive a message in a special telegram group: “a deviation from the trading strategy occurred”, which contains detailed information about the current state of the trading pair, the specified settings and discrepancies. After that, the responsible employee adjusts the strategy settings or performs manual operations with the account directly on the exchange.

After completion of technical work and testing, the team conducts a presentation of the market making work for the client. At this stage, the regulations for the launch and operation of market making, interaction with the client, and the final logic of the trading strategy are approved.

Next, the team proceeds to launch market making in the “combat” operating mode. After the launch of market making, the client receives reports on the work, the technical team monitors and manages the market making. If necessary, the trading strategy and automatic market making settings are adjusted.

Telegram

Telegram