Fintech Software Development Company

Helping businesses achieve their goals for over 10 years. Building apps that make profit. Attracting paying customers.

- Apps Development

- Cryptocurrencies and Blockchain

- Web3 and DeFi platforms

- Influencer Marketing

- PR and Media

- Community Management

Our Services

We develop web and mobile applications, conduct effective marketing campaigns. How to immerse yourself in all the variety of services and understand what kind of set you need? Let's start with concept development!

Fintech Development Services

We develop for fintech: mobile banking, payment systems, and crypto projects (blockchain apps, crypto wallets, crypto trading platforms, DeFi, and Web3).

Fintech Marketing Agency

Everything you need to promote and drive traffic: influencers and bloggers, PPC advertising, SEO for crypto projects, community management, PR and media.

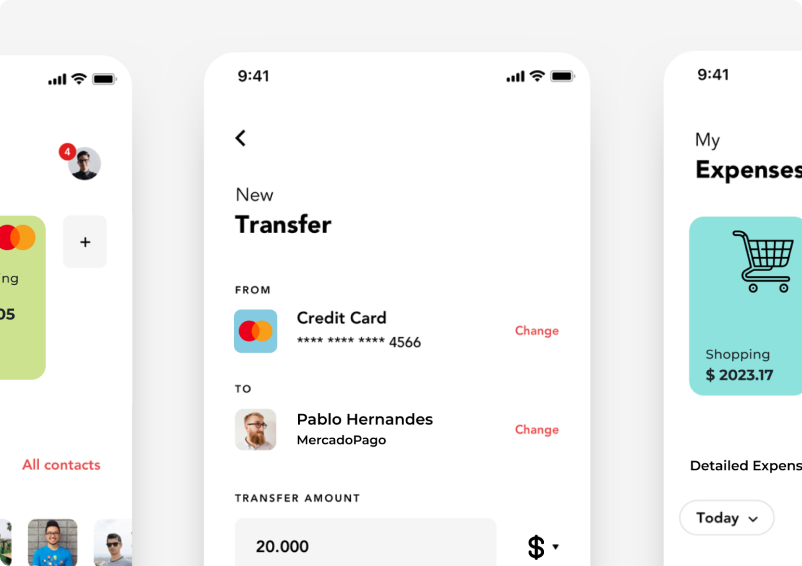

Mobile App Development

Development of cutting-edge mobile applications for iOS and Android. Artificial intelligence, highload, nice and user-friendly design of mobile applications - that's about us

Listing and Market Making Services

Marketmaking is the process of market formation and trading for a cryptocurrency. It consists of two parts: listing on a crypto exchange and filling order books with liquidity, as well as managing the rate.

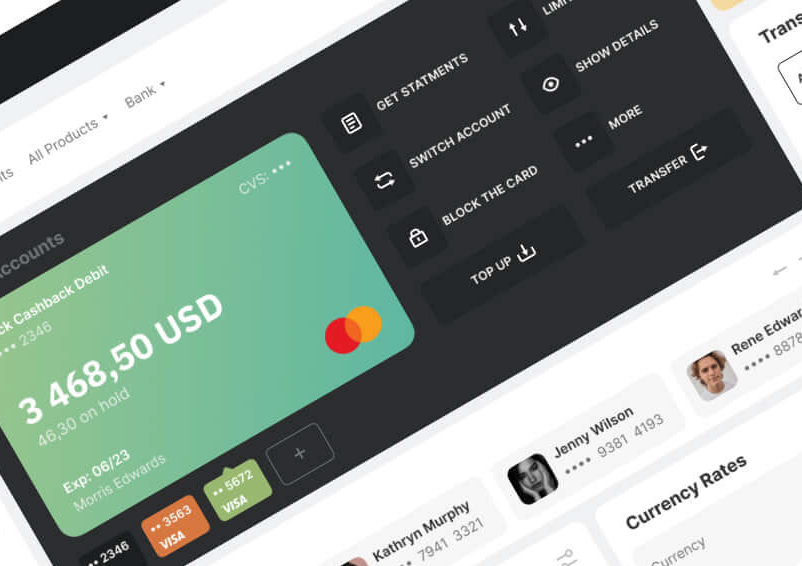

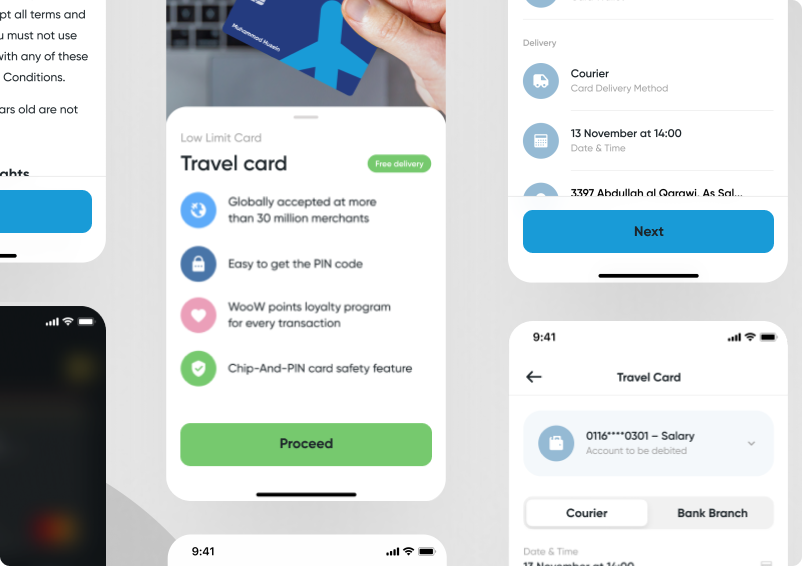

Mobile Banking App Development

Development of functional mobile banking systems that can become a powerful driving force for your business.

Cryptocurrency Wallet Development

Development of custodial and non-custodial crypto wallets with a user-friendly interface for any platform (web, desktop and mobile wallets).

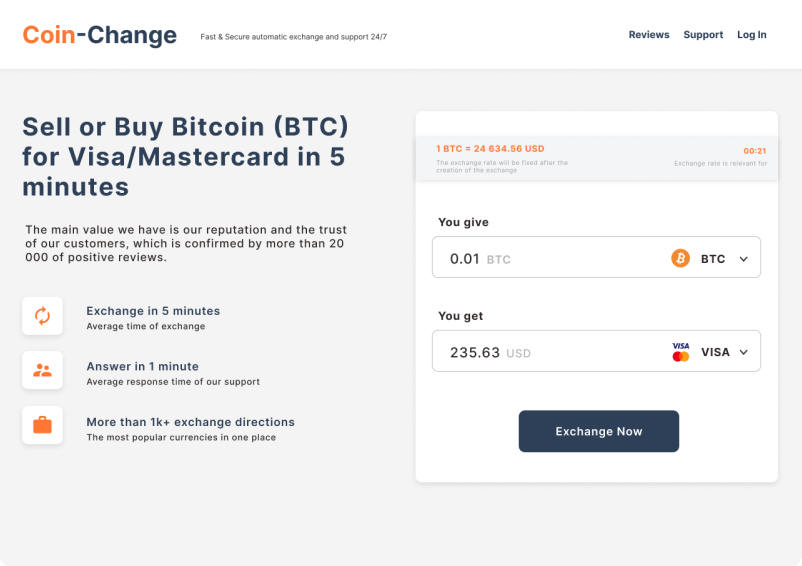

Cryptocurrency Exchange Development

Development of decentralized and centralized cryptocurrency exchanges, exchangers and P2P platforms with a modern design and flexible functionality.

Recent Cases

Direct Access to Most Reliable Resources

Media and Press

YouTube

Dear Customers About Us

Feel Free to Contact Us

Polygant is a leading fintech software development company that specializes in providing innovative fintech software development services.

Polygant excels in fintech software development by leveraging the latest technologies and industry best practices to create scalable and secure solutions. Our team of talented fintech software developers possesses deep expertise in crafting tailored solutions that address the unique challenges faced by our clients.

Polygant’s services cater to various entities in the financial industry, including financial institutions, fintech startups, and software vendors. We are a trusted partner for all fintech software development needs.

Polygant offers a comprehensive range of fintech software development services, including financial software development services, custom software development services, fintech mobile app development services, and consulting services.

Polygant has extensive experience working with financial institutions and offers specialized solutions tailored to meet their unique needs. Our financial software development services empower banks, credit unions, and other financial organizations with scalable and secure software solutions.

Polygant understands the dynamic nature of the fintech industry and provides agile and innovative solutions to fintech startups. We assist in developing cutting-edge software solutions that help startups differentiate themselves and stay ahead of the competition.

Polygant specializes in fintech mobile app development, creating feature-rich and user-friendly mobile banking apps. Our mobile banking apps provide intuitive and convenient solutions, enhancing customer engagement.

Yes, Polygant provides consulting services to help businesses make informed technology decisions. Our consulting services encompass technology roadmapping, system integration, and digital transformation initiatives, leveraging our industry knowledge and experience.

Polygant develops advanced document management systems for financial institutions to streamline processes, enhance security, and improve collaboration. Our solutions optimize operational efficiency and ensure compliance with regulatory requirements.

Polygant actively collaborates with fintech startups, offering tailored fintech software development services to support their growth and success. We help startups bring their innovative ideas to life and revolutionize the industry.

Polygant focuses on digital banking and offers end-to-end digital banking solutions to enable financial institutions to embrace digital transformation. Our solutions create intuitive and secure digital banking experiences that drive customer engagement and loyalty.

Polygant’s comprehensive fintech software development services empower businesses in the financial industry to drive digital transformation, enhance operational efficiency, improve customer experience, and stay competitive in the evolving fintech landscape.

In conclusion, Polygant is a leading fintech software development company that offers comprehensive solutions to the financial industry. Our team of talented fintech software developers provides innovative fintech software development services, enabling success in the fintech landscape.

Telegram

Telegram